The Enterprise Software Industry is Looking Terribly Bleak Right Now

What's The Chances of it Going The Way of The Dinosaurs?

The market has already begun to prove the obvious. Enterprise software the trillion‑dollar, subscription‑heavy machine that powered corporate technology budgets for decades, is being criminally mispriced for extinction.

Investors smelled it first. The WisdomTree Cloud Computing Fund (WCLD) is down roughly 20% in 2026. The S&P 500 software and services index has swept away about $1 trillion in market capitalization since January 28, 2026 as panic replaced complacency.

This is not a blip. It’s a verdict. And its not good for those in the industry.

The Facts That Can’t Be Ignored

Market carnage: Reuters and multiple outlets report the S&P 500 software & services index shed roughly $830B-$1T in a single week as investors weighed AI’s capacity to displace software vendors’ revenue streams. (Reuters, Feb 4–5, 2026; CNBC, Feb 5, 2026.)

ETF rout: The WisdomTree Cloud Computing Fund plunged ~20% YTD in 2026 amid the “AI will eat software” narrative and heavy re‑rating of cloud and SaaS names (CNBC; MarketWatch/WisdomTree fact sheets).

Adoption plus automation: McKinsey, Deloitte and other enterprise studies show massive AI deployment across business functions (McKinsey Tech Outlook 2025; Deloitte State of AI 2026). Agentic AI and GenAI moved from pilots to production at scale in 2025–2026.

Vibe coding and AI app builders: Tools that convert plain English into deployable apps—“vibe coding” workflows (Replit, Google AppSheet, Microsoft Power Apps/Copilot, Cursor, etc.) matured through 2025–2026. Enabling non‑technical staff to generate working applications and automation at a fraction of legacy software costs.

Developer displacement an productivity: Broad industry surveys (GitHub/Stack Overflow/industry analyses) show 70-90% developer adoption of AI assistants and measurable productivity gains. AI now generates a very large share of routine code and repetitive outputs, accelerating feature delivery and eroding the moats that justified premium SaaS multiples.

Consulting and integration at risk: The “interface tax” and multi‑vendor orchestration businesses that bolstered enterprise software economics are being repealed as AI agents orchestrate integrations and routine processes without human middlemen (several industry think pieces and consulting reports, 2025-2026).

The Threat is Existential Not Cyclical

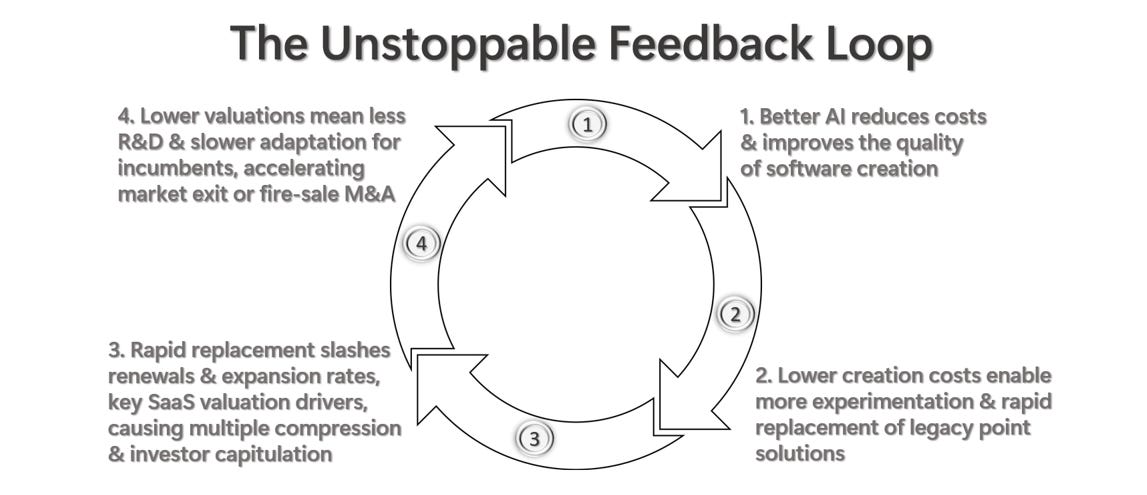

1. The product is being replaced by a capability. The value buyers paid for, workflow automation, document review, CRM, analytics can increasingly be replaced by AI agents that sit above or between legacy apps and perform the same business outcome for less money and faster. Anthropic’s Claude plugins and Microsoft/Google agent stacks are moving the “application layer” into LLMs and agent orchestration. When the outcome is the metric buyers care about, the vendor that sells the UI loses pricing power.

2. The economics break. SaaS survived because recurring licenses locked in predictable ARR and high gross margins. AI flips that; enterprises will buy compute, models, data pipelines, and outcome‑based services (or build internal agents) instead of dozens of seat licenses. Budget reallocation to hyperscalers and model providers starves mid‑market and niche software vendors.

3. Barrier to entry collapses. “Vibe coding” and AI app builders compress build time from months to minutes. Non‑technical product owners can spin up incumbent‑killing prototypes at low cost. The old advantages; deep feature breadth, channel teams, lock‑in are subject to fast, cheap imitation.

4. Network and data advantages concentrate. The winners will be those who own vast proprietary data plus compute (hyperscalers, dominant platform owners). Everyone else becomes a feature, not a platform. That concentration accelerates value migration away from mid‑cap software firms to a handful of AI infra and model owners.

5. Trust and compliance are survivable edges, but too expensive. Regulated industries will slow adoption of purely AI‑driven replacements, but they will not save legacy vendors forever. Enterprises will rearchitect around audited, governed agent stacks, likely supplied by hyperscalers or specialized AI services further marginalizing standalone software vendors.

What The Data Already Tells Us

Sector multiple shock: Software price/earnings and price/sales multiples compressed across 2025-2026 as growth expectations were repriced (multiple reporting from Reuters, CNBC, Business Insider).

Capital flows: Hedge funds and short sellers piled into software in early 2026; ETFs tied to cloud and software collapsed, indicating broad repricing (CNBC, Reuters, S3/Ortex cited in coverage).

Adoption metrics: Surveys (Deloitte, McKinsey, Stack Overflow) show enterprise AI adoption leapt in 2024-2025 and moved to production in 2025-2026 timelines too fast for incumbents to adapt without radical business model changes.

The Bad News For CEOs & Investors

If you’re an enterprise software CEO

You have two years, maybe less to pivot from selling features and seats to owning outcomes, data, and agent orchestration. If you cling to license-based economics, you will be repriced out of existence.

If you’re an investor

Don’t confuse technical EBITDA or short-term cashflow with terminal value. The steady recurring revenues you love are now detachable and replaceable. Valuations will compress to reflect the new reality: software that doesn’t capture AI spend, own the data layer, or embed governance is worth a fraction of yesterday’s multiples.

The Counter Arguments

Yes, some firms will adapt. Hyperscalers, deep‑data incumbents, and specialist vendors that embed AI and control data pipelines will survive and consolidate power.

Yes, large enterprises still need migration, audits, and integration expertise; transition services that incumbents can sell for a while. But adaptation is costly and uneven.

Many mid‑market vendors lack the balance sheet, data assets, or strategic vision to pivot. And peer‑reviewed and industry analyses (AlixPartners, McKinsey, PwC, Deloitte) warn of mass displacement and a re‑ordering of vendor economics in 2026.

The Very Near Future: Brutal Fast & Decisive

This is not gradual evolution, with Agentic AI fast evolving plus cheap app synthesis this creates high levels of discontinuity; you can expect:

A sustained re‑rating of mid‑cap enterprise software multiples.

Rapid consolidation and opportunistic M&A where buyers buy data and customers, not product roadmaps.

Emergence of a small set of AI‑centric platform owners and orchestration layers controlling enterprise workflows.

A death spiral for companies that survive on seat licenses, inflated retention narratives, and legacy sales motions.

Survival Tips

Stop selling seats. Move to outcome/consumption pricing that captures AI value.

Own the data contracts and pipelines; monetize the dataset, not the UI.

Build or partner for agent orchestration and governance; be the safe, auditable layer enterprises trust.

Reinvest heavily in model fine‑tuning, evaluation, and reliability engineering as AI Quality Control is the new table stakes.

Prepare for portfolio reshaping; cut slow products, focus on mission‑critical, hard‑to‑replicate capabilities.

The Impending Near Future

The enterprise software industry as we knew it; license/seat economics, endless product features, salesforce-driven expansion was already on life support. AI has pulled the plug.

What remains will be reconstituted; fewer winners, massive consolidation, and a set of AI infrastructure and data owners that command the economics software once did.

For the rest, extinction is not hyperbole, it’s the likely outcome unless they reinvent themselves as AI‑native, data‑centric, outcome‑selling businesses and fast.

If you’re comfortable with nice things like professionalism, decorum and slow change, go back to spreadsheet forecasts.

Here’s the truth without the BS; software’s golden age is ending, and agentic AI will bury the business model that supported it. But by all means feel free to sit-on-the- fence and see what happens…regardless, the clock is ticking…

I am a remote WFH logistics/supply chain specialist with 25+ years of experience, if you can use my type of expertise, please feel free to get in touch.

#AI #GenerativeAI #SaaS #EnterpriseSoftware #NoCode #VibeCoding #CloudComputing #SoftwareStocks #TechBubble #AIDisruption #FutureOfWork #SaaSCollapse